When you own a bank account, whether savings or current, the bank requires you to maintain a certain amount in the account during a specific period of time. That is called ‘minimum balance’ or ‘average balance’. The specific duration can be a month or quarter. If the minimum balance is prescribed for a quarter it’s known as ‘Quarterly Average Balance (QAB) and if it’s prescribed for a month it’s called Average Monthly Balance.

In this article, I have explained how to calculate Quarterly Average Balance. But before that I have taken a moment on what Quarterly Average Balance means and how it is determined. I hope it helps you understand the minimum balance requirement of your bank account.

What is Average Quarterly Balance?

Average Quarterly Balance is the amount you are required to maintain in your account over a period of three month or one quarter.

How to Calculate Quarterly Average Balance?

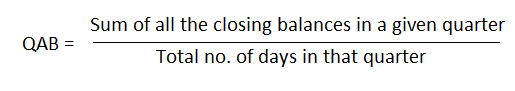

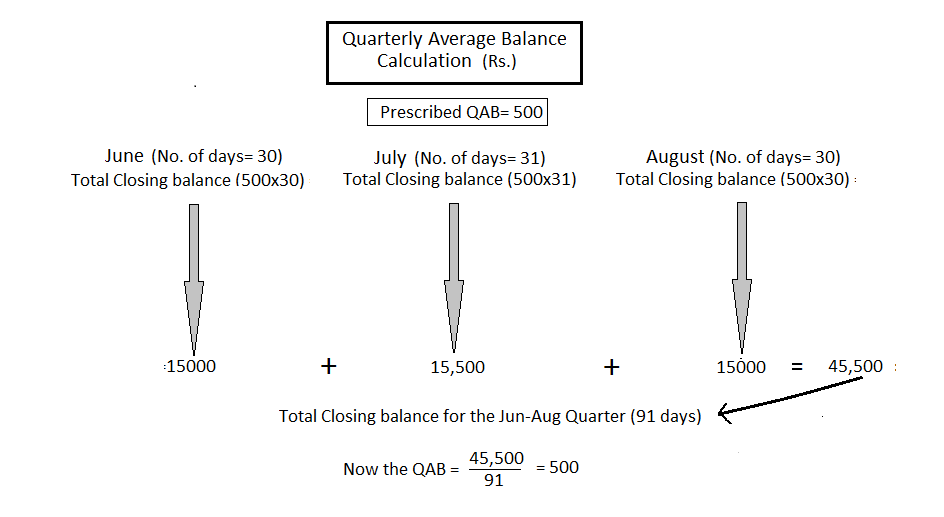

The QAB is calculated by adding the Closing Day Balances and dividing the sum by the number of days in the quarter.

For a simple understanding, if the QAB of your account is Rs.500, you need to have at least Rs.500 in the account at the end of the day for the entire quarter. In the example below, we have taken the Jun-Aug quarter and we have decided to maintain Rs.500 as closing day balance for the entire span.

However, you are not bound to maintain the same amount at the end of every single day in order to catch up with the QAB. This is impractical from any point of view.

But it’s important to make sure the average of daily closing balances over the quarter is equal to or higher than the prescribed QAB, not less. This is very important.

However, if you are not sure you can maintain it you can either keep Rs.45,500 for one entire month or Rs.15,500 for entire span of 3 months. Both the ways, you will be able to maintain the required QAB.

Here is an excellent read on how to calculate Quarterly Average Balance.

Average Quarterly Balance or Quarterly Average Balance (QAB) varies depending on the type of account and from bank to bank. For example, the basic savings account or No frill account do not have a minimum balance requirement.

Smart Things to Know About QAB

1) Average Quarterly Balance or Quarterly Average Balance (QAB) may vary depending on the

- Type of account

- Type of bank, whether public or private

- Location of the bank (urban/metro, semi-urban, rural)

2) Usually the basic savings account or No frill accounts do not require a minimum balance.

3) If an account holder fails to maintain the QAB and the balance goes below the prescribed amount, the bank enforces penalty or non-maintenance charges. The charges may vary from bank to bank.

4) Account Holders must retain the information regarding QAB. They can either find it in the information brochure or simply ask the banker.

5) The QAB or say, minimum balance requirements in public sector banks is usually less than that in private sector banks. The same holds true for the penalty of non-maintenance of QAB. While Banks like SBI, PNB ask for around Rs.500 as QAB for normal savings account, private bodies such as HDFC, AXIS bank or ICICI demand as high as Rs.10,000 for QAB..

6) Certain banks prescribe Average Monthly Balance instead of QAB. This is the average of the closing day balance in the account during a calendar month.

What is Average Monthly Balance?

Average Monthly Balance is almost same as Average Quarterly Balance except for the duration. In QAB the average balance is prescribed over a period of three months, but in Average Monthly Balance it’s for one month.

Here the calculation is done by adding the Closing Day Balances and dividing the sum by the number of days in the calendar month.

Yes bank, HDFC bank, Axis bank, and ICICI bank are some of the private sector banks in India that prescribe Average Monthly Balance for their savings accounts.

In Yes bank, the Savings Value* scheme has Rs.5000 MAB requirement and it levies up to Rs.500 max as non-maintenance charge. Click here to learn more about YES bank minimum balance requirement for different savings schemes. Check the revised charges and fees for various savings accounts by clicking on the boxes right below the scheme names.

To know about HDFC bank minimum balance requirements for various savings account schemes, Click on the following link. You will find the names of different saving schemes on the screen. Click on “view details” at the end of each scheme and go to “what are the fees and charges of — account” section. Click here to go the page.

You can also calculate your average monthly balance with the help of a calculator given by HDFC bank.

Likewise here are some quick links to take you to the information pages of Axis bank and ICICI bank. Here, you just have to select the type of savings account you are looking for and all the information regarding its minimum balance requirement and MAB charges will be available on the page. Since there are so many schemes and each of them has its own fees and charges depending on the locations, it’s difficult to sum up in one page. Please, use the links below and check them out.

Axis bank minimum balance requirement and non-maintenance charges

ICICI bank minimum balance requirement and MAB charges

RBI Guidelines for Minimum Balance

However, on 20th November 2014, the RBI specified some revisions on the levy of penal charges on non-maintenance of minimum balance/quarterly average balance in savings account.

According to the guidelines,

- With effects from April 1st 2015, the banks are required to notify the customer by SMS, email or letter, that they will be liable to penalty if the minimum balance is not restored in the account within a month from the date of notice.

- The penal charges should be a fixed percentage levied on the amount of difference between the actual balance maintained and the minimum balance as agreed upon at the time of opening of account.

Recommended Reading: RBI circular on Levy of penal charges on non-maintenance of minimum balances in savings bank accounts

So these are some of the basic pieces of information on QAB and MAB in India. Now that you know how to calculate Quarterly Average Balance, make sure you maintain it well in order to avoid unnecessary charges.

how is the average quarterly balance calculated when an customer opens an account in the middle of quarter? is the quarterly balance calculated for that quarter? if yes what is the number of days being considered?