In the era of technological transformation, the digital presence of banks has potentially replaced the bank branches.

According to research conducted by global consultancy firm, KMPG in August 2015, the number of mobile banking users globally is likely to double to 1.8 billion which is over 25% the world’s population, in the next four years.

More interestingly, the mobile banking users in India account for over 50 per cent of its population today.

The Global Mobile Banking Report says the mobile banking and payment systems are increasingly being integrated with other technologies, driving an era of “open banking”.

Here are some key findings on Mobile banking in India.

- India has the youngest population of mobile banking users across the globe.

- Banks are increasingly adopting ‘Mobile Firs’ technology.

- Large banks are already acquiring technology start-ups to keep up with the rapid pace of change and the growth of challenger banks

- Challenges including cyber security and the lack of collaboration with developers are preventing banks to innovate and capitalize upon ‘open banking’

The report also reveals that there is a likelihood of changing banks driven by the availability of better mobile banking services.

Hence, the surge in mobile banking is quite prominent, and banks are readying themselves to take the advantage of it.

India is home to around 150 banks including public sector banks, private sector banks, RRBs and urban co-op banks.

Talking of public and private sectors banks alone, almost all of them are available on mobile banking platform. But are all of them equally well as far as performance and user experience is concerned? I will be expecting the answers from the readers in the comment section.

For now let’s talk about the best mobile banking apps in India.

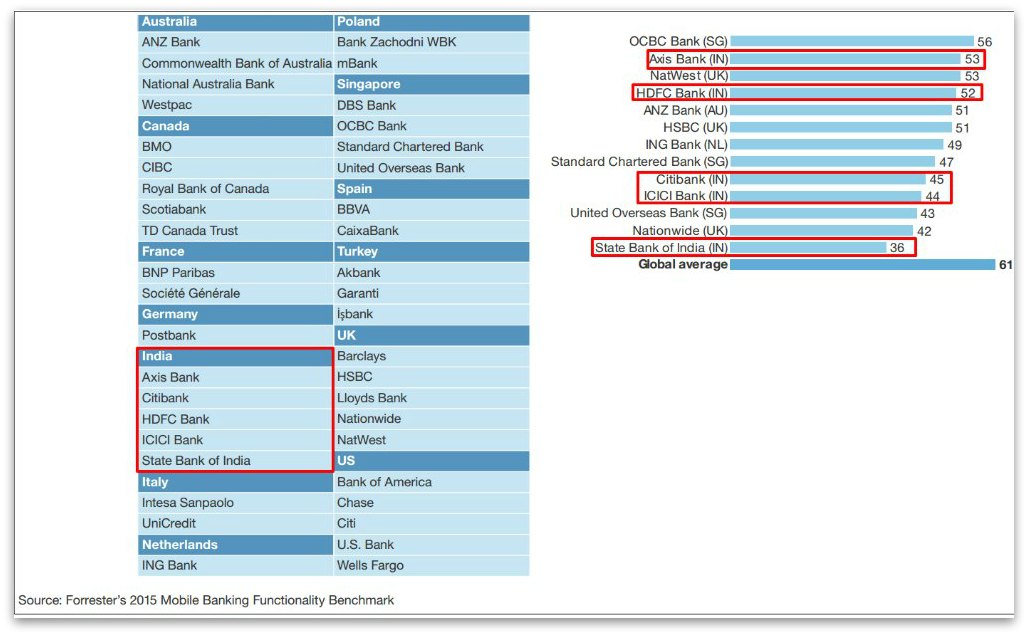

The report- 2015 Global Mobile Banking Functionality Benchmark– prepared by Forrester, an American Independent technology and market research company reviews the mobile banking services of 41 large retail banks in 13 different countries including India.

The mobile banking services were measured on different parameters and assigned ranks on a 100-points scale. Here are the scores.

Mobile Banking Apps in particular, are a major element of mobile banking services. Considering the report we have five mobile banking apps of those who are among the largest retail banks across the globe. Although the ranks are not outstanding, they have certain features appreciated by the researchers.

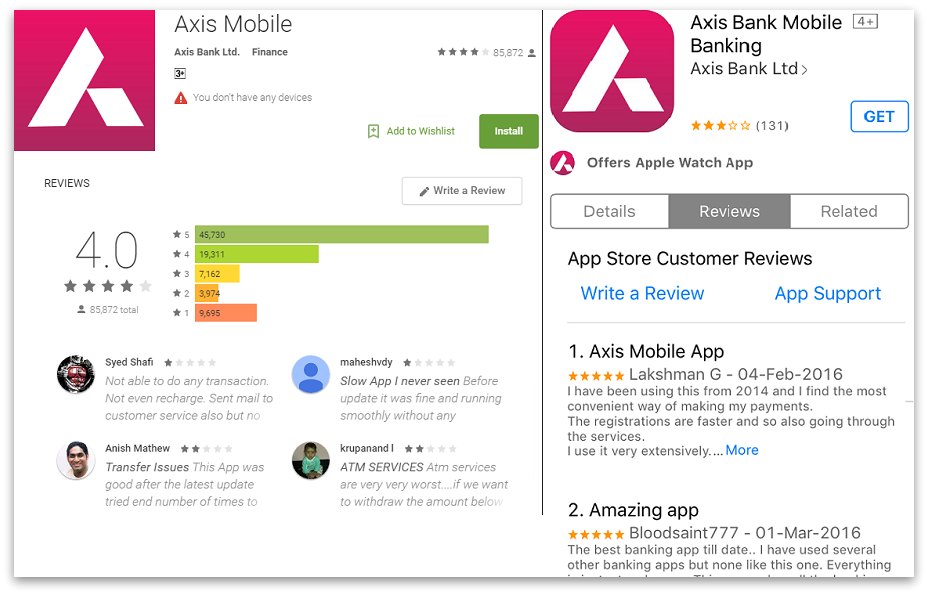

Axis Mobile

The Axis Mobile is available for Android and iPhone users. The app is user friendly, and it offers a wide range of functionalities at the touch of a button.

Using the app, you can view your account summaries and mini statements, access credit cards and debit cards and loan accounts as well. Besides you can convert your credit card transactions into EMIs.

Going by the current user reviews, there are some bugs post latest updates which are needed to be fixed.

Android user review score-4/5

Apple user review score-3/5

2015 Global Mobile Banking Functionality Score of Axis Bank- 53/100

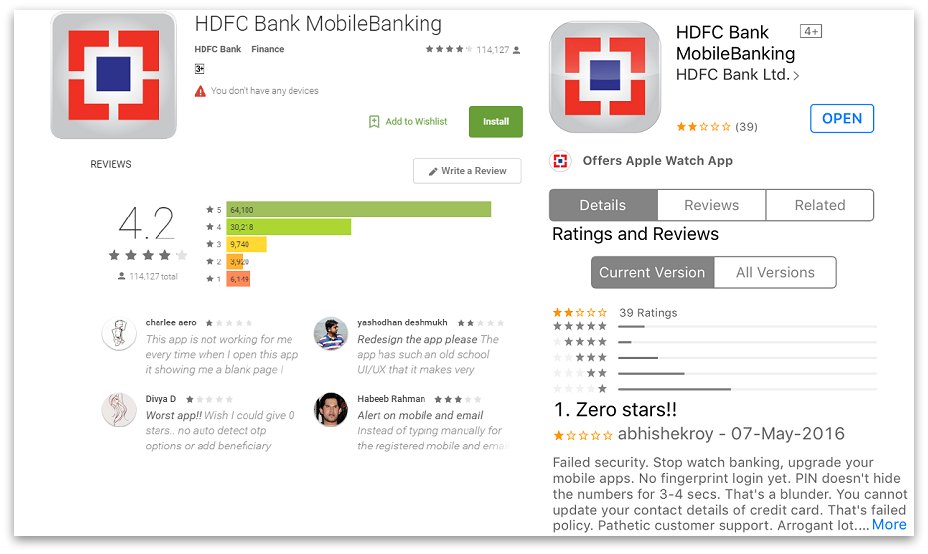

HDFC Bank MobileBanking

Available on Android and Apple, HDFC Mobile Banking App works fine for me.

It lets you perform a host of banking operations ranging from account statements to RD account creation. You can also view FD account summaries, transfer funds, and request cheque books using the app.

Some users do complain about the old school user interface, but that’s okay as long as it performs well.

Android user review score-4.2/5

Apple user review score-2/5

2015 Global Mobile Banking Functionality Score of HDFC Bank- 52/100

Citibank IN

Citibank IN, mobile banking app of Citi Bank is compatible with Android as well iOS mobile platform. The app is pretty popular among Android users with an average score of 4 out of five.

The app can be used for a number of services. It helps you locate Citi Bank ATMs, branches, and retailers offering Citi Bank privileges. Using the app you can transfer funds, pay bills, request E-statement and so on.

Android user review score- 4/5

Apple user review score-2.5/5

2015 Global Mobile Banking Functionality Score of CITI Bank- 45/100

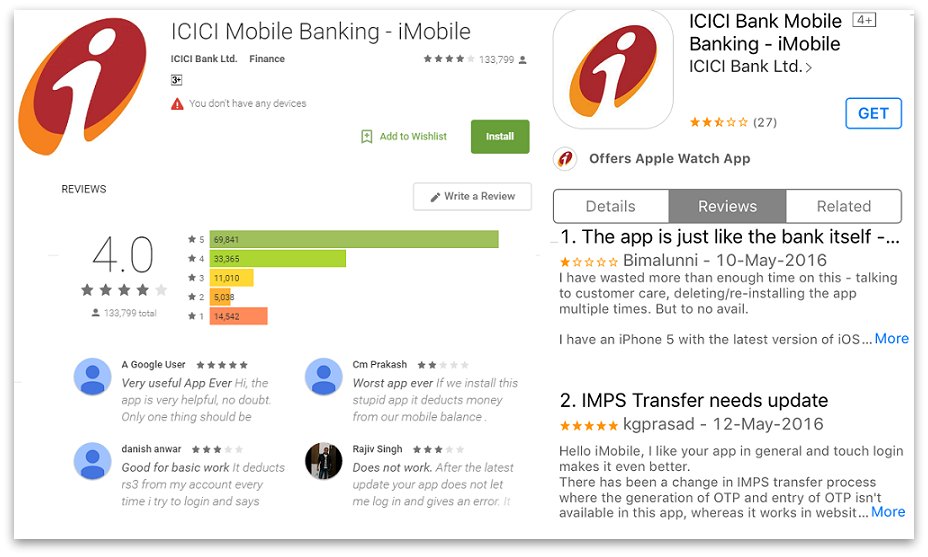

iMobile ICICI Mobile Banking App

ICICI bank’s official iMobile is said to be the most comprehensive and secure mobile banking application offering over 100 banking services on your mobile.

It lets you transact from all accounts including loans, PPF, Insurance, iWish.

You can create RDs, FDs quite easily and transfer funds from your savings account. Besides, accessing insurance accounts, locating ATMs, status enquiry of cheques- everything is there at your convenience.

Moreover, you can check the information about bank, credit card accounts, balance details and last 3 transactions on your Smart watch by using iWear – ICICI Bank’s Android Wear Banking application:

Android user review score- 4/5

Apple user review score- 2.5/5

2015 Global Mobile Banking Functionality Score of ICICI Bank- 44/100

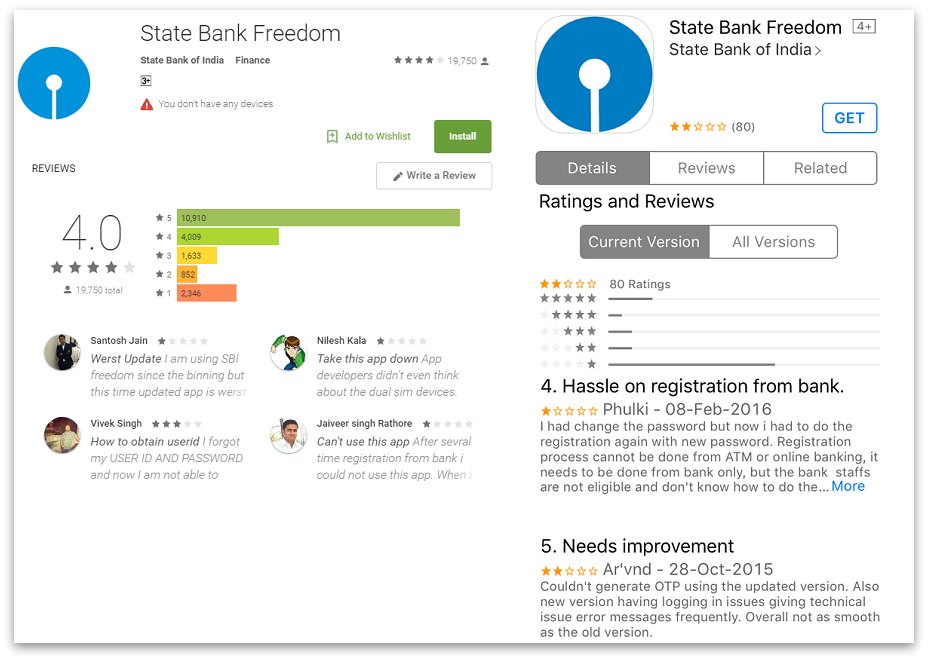

State Bank Freedom

The State Bank Freedom offers a host of banking services including balance enquiry, money transfers to loved ones, and bill payments at any hour of the day.

With some simple steps of registration the app is ready to use. You can not only access your accounts, but you can create or close FDs/RDs.

Other services offered by State Bank Freedom includes cheque book request, mobile recharge, post paid bill payment, booking of train tickets over IRCTC portal through IMPS.

Apple user review score- 4/5

Android user review score- 2/5

2015 Global Mobile Banking Functionality Score of State Bank of India- 36/100

However, there are many banks out there who offer excellent mobile banking services to users. Therefore, you should visit the app page of a bank on Google Play/ Apple App Store, and read the user reviews before selecting a bank over its mobile banking services,

Reading the reviews from actual users who know the app inside out will give you a better idea on this.

I very much appreciate your write up and is looking for a digital cash collections app for Micro Finance institutions.

Any product you have in mind will very much welcomed.