Fixed deposits are the most suitable investment options for people, who want to invest a lump sum amount of money for a fixed period of time at a low risk.

As far as share market investment is concerned, which is comparatively a better investment option for long term benefits despite the involvement of risk, there are many people in India who either don’t know about such options or don’t want to get in to the complicacies of market fluctuation. To them, fixed deposits will continue to remain one of the best and safest investment options.

This article is all about fixed deposit and fixed deposit interest rates in India. The content will help you compare the returns and plan your investment.

What is a Fixed Deposit?

When a person deposits a lump sum amount with a bank, post office or other financial institution for a fixed period of time and the entity pays him interest for the specific duration, the deposit is called a “fixed deposit”.

Fixed deposits are safe investment options that can be easily created by individuals, trusts, pvt. firms, public limited companies and so on, by providing necessary KYC documents.

What Benefits Does FD Offer?

There are many reasons why Fixed Deposits are popular among others. Here is a few of them.

1. Safe and Guaranteed Return

Unlike investments in stocks and shares, fixed deposits are not affected by market rate fluctuations. The depositors can rest assured that they are going to get the specific maturity amount at the end of the tenure.

2. Flexibility in Duration

The duration of fixed deposits is quite flexible, ranging from 7 days to 10 years. Investors can choose the duration of their fixed deposit according to their needs. It can be 6 months, 1 year or 5 years, depending on their financial goals.

3. Flexibility in Interest Pay-outs

Fixed deposit interests can be paid monthly, quarterly, annually or at the time of maturity depending on the investor’s choice.

4. Easily Withdrawable

Fixed deposits allow easy withdrawal and premature closure. The amount of money invested in fixed deposit can be withdrawn after deducting a small amount of penalty. This is a useful feature, in case of financial emergencies

5. Habit of Saving

Since the minimum amount of fixed deposit can get as low as Rs.100, why wouldn’t somebody want to fixed deposit it and earn interest which is much higher than that in savings accounts. Fixed deposits, being much flexible in terms of interest pay outs, duration, and withdrawal, are a useful way to save money for both long term and short term financial goals.

6. Over Draft and Loans Against Fixed Deposits

Investors can easily apply for over-draft facility or loans in banks against their fixed deposits. The banks will sanction a certain percentage of their fixed deposit as loan amount.

Things You Should Consider While Investing in Fixed Deposits in India

- It is always better to have a wide investment portfolio. Instead of putting all your money in fixed deposit in one bank, you should invest it with different providers. So you can break any one of them, in case of urgent financial needs.

- Fixed deposit interest rates keep changing with time. To benefit from an increase in interest rate, you can split a lump sum amount and invest them with different maturity periods.

- Choose the right duration for your fixed deposit.

- The interest earned on the fixed deposits you have created in the name of your child or spouse, will be considered in your income tax calculation.

Fixed Deposits Interest Rates in Banks

Fixed Deposit Schemes are one of the major deposit schemes offered by banks in India.

Fixed deposits in banks can be availed for a duration ranging from 7 days to 10 years. And customers are free to choose the duration according to their short term or long term goals.

The rate of interest offered by a bank may vary depending on the duration and amount of fixed deposit. When the tenure is as short as 7 days, the interest rate is almost same as the rate applicable to savings accounts.

The interest in fixed deposit is calculated on quarterly compounding basis, which is deposited on specific interest pay-out intervals as decided by the customer.

Moreover, the interest is usually higher for senior citizens. They usually earn 0.5% extra on the prevailing interest rate.

When the interest earned on fixed deposits exceeds Rs.10000 in a year, it becomes taxable and bank is required to deduct the TDS amount. But if your total income is below the exemption limit, you have to deposit 15G (for normal customers) or 15H (for senior citizens) to avoid tax deduction at source.

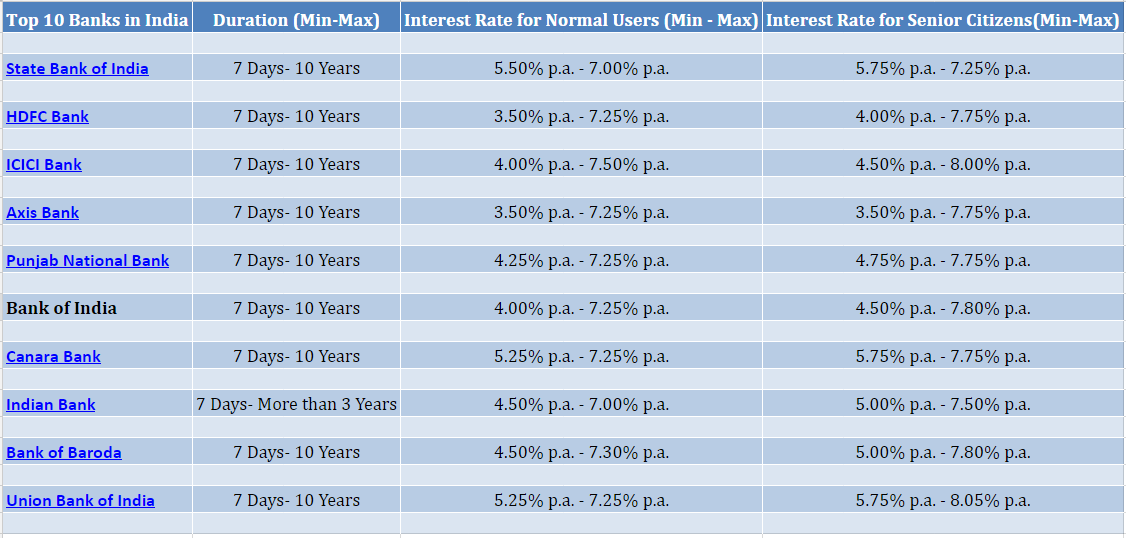

Here is a list of FD interest rates(as on 20th May 2016) in top 10 banks in India.

Post Office Time Deposits

Post Office Time Deposits can be opened with a minimum of Rs.200 and there is no maximum limit on the deposit amount.

The minimum duration of the scheme is 1 year and it matures after 5 years.

Depositors can open any number of accounts in any post office. Term Deposits made with duration of 5 years are eligible for tax benefits under section 80C of Income Tax Act, 1961.

Interest Rates of Post Office Time Deposits from 01.04.2016,

Time Deposits made for one year- 7.1%

Time Deposits made for two year- 7.2%

Time Deposits made for three year- 7.4%

Time Deposits made for five year- 7.9%

The interest in Post Office Time Deposits is calculated quarterly, but payable annually.

Here is a great tool to calculate FD interest.

Factors Affecting Fixed Deposit Interest Rate in India

Fixed deposit is often considered a conservative way of investing money. However, it’s still one of the most preferred options available in India that offers guaranteed returns on maturity.

Even though it’s immune to the fluctuations in market rates, there are certain factors that affect the fixed deposit interest rates.

(I remember in the year 2013-14, the interest rates on fixed deposits were fairly high. It was around 9% for normal users and 9.5% for senior citizens. Many customers showed up with a bunch of fixed deposit receipts asking for their renewals in order to get the latest interest benefits.)

Although the increased interest rates remained for quite some time, they gradually went down to 8% in 2015 and currently they are almost around 7.5% in most of the PSU banks.

If you are wondering why banks cut the interest rates on FDs, the answer is like this.

The rise and fall in FD interest rates often depends on factors like liquidity, and demand and supply condition of credit. When the demand of credit is high, banks increase the rate of interest to attract more investors as they need more money (liquid assets) to lend. On the other hand, when the demand for credit is poor, they cut the interest rate.

Assuming the same to continue in coming years as well, all you need to do is make a proper research on FD interest rates offered by banks, NBFCs and companies and take an informed decision.

If you only want to invest in FDs, compare the interest rates offered in National Saving Certificates and Post Office Time Deposits as well before selecting a scheme. Although, you can also go for Company FDs, since they offer higher interests, you should also consider the risk factors before you invest.

Leave a Reply