What is a Recurring Deposit Account?

A recurring deposit is a special kind of term deposit where people can save a fixed amount every month and earn interest. Basically, the purpose of a Recurring deposit account is to inculcate a habit of saving among people. And it’s really important that we save on a regular basis because this is what helps us manage our financial liabilities in the future.

Recurring deposits can be opened in banks and post offices. In fact, this is a very good investment option for people with fixed incomes or salaried persons as it helps them build a safe financial provision for themselves without involving any market risk. The best part is, almost anyone with basic KYC documents can open it without much restriction.

Benefits of Recurring Deposit

No Risk Involved: Recurring deposit is one of the safest ways of investing money. These are not influenced by the market turbulences, so the maturity amount doesn’t involve any market risk. The account holders get the entire investment amount along with the interest at maturity.

Interest on Regular Savings: The interest is applicable to all the monthly deposits you make in the RD account, even on the first one. And it increases with the subsequent deposits since it’s calculated on a compounding basis. You get more interest depending on the tenure you have selected.

Financial Provision: At the time of maturity, you get a lump sum amount which includes the amount deposited by you and the interest earned on them periodically.

Loan Against RD: You can avail loan/overdraft against your RD account in case of emergency.

Recurring Deposit Interest Rate

The interest rate on recurring deposits is the same rate applicable to fixed deposits in a specific bank and it can vary depending on a few factors.

- Type of Account: In the case of Senior citizens, banks offer higher interest on recurring deposits when compared to regular RD accounts. Senior citizens earn 0.5% more than the prevailing rate of interest per annum. However, NRE/NRO recurring deposit accounts are offered lower interest rates. Even senior citizens who fall under this category are not eligible for additional interest rates.

- Duration of Deposit: The interest rate also varies depending on the duration of the deposit. However, it may not apply to all banks.

- Choice of Bank: The interest rate is more or less different in different banks.

- Nature of Scheme: Banks introduce lucrative RD schemes with higher interest rates and a specific tenure. Such schemes are focused on the long-term benefits of account holders since they are offered a huge lump sum amount at the time of maturity.

Recurring Deposit Interest Calculation

The interest calculation on recurring deposits is done by compounding the interest on a quarterly basis.

Compound Interest = The interest that has been added to the principal amount also earns interest in the subsequent interest calculations.

The addition of interest to the principal is called compounding.

Example: In January, Haris opened an RD account with a core amount of Rs.3000 and deposited the same amount for the subsequent months.

Towards the end of March, he gets the first accumulated interest (say,Rs.x) of the year, which applies to the total amount deposited for Jan,Feb, and Mar i/e Rs.9000.

Now, the balance in his RD is Rs (9000+x).

As per the compound interest method, (provided Haris hasn’t missed a single monthly installment) the interest for the next quarter will be calculated on the sum of the amount deposited until that duration and the first interest “x”. This means, for the Apr-Jun quarter the interest will be calculated on Rs.(18000+x).

The same rule applies to all the following quarters of the tenure.

RD Interest Calculation Formula

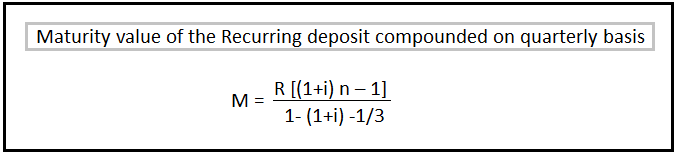

Here is the formula that applies to RD interest calculation in the quarterly compound interest method.

Where,

M = Maturity value

R = Monthly installment

n = Number of quarters

i = Rate of interest/400

Who Can Open a Recurring Deposit Account?

Resident Indians, NRI/NRO, Minors under the supervision of their guardians, sole proprietorship or partnership firms, organizations etc. can open an RD account in banks by producing the necessary documents. Moreover, anyone can open a recurring deposit account without much restriction.

What Are the Documents Required?

To open a recurring deposit account you need to have two passport-size photographs, a duly filled and signed application form, KYC documents (ID proof & address proof), and other documents if applicable. However, if you already have a savings account in the bank and you comply with the KYC norms, they may not require KYC documents once again. You only need to submit the application form (filled and signed) and passport-sized photographs ( one for the application form and one for the RD passbook).

How to Open a Recurring Deposit Account?

To open an RD account you can either visit a bank or post office and follow the steps advised by them. If you are using net banking or mobile banking facility for your existing bank accounts, you can open the RD account from those platforms as well. In fact, doing it online is often convenient as it saves time and automatically deducts the amount from your savings or current account.

How to Deposit in Recurring Deposit Account?

This is very easy. You can physically visit your bank or any branch office to make payments through cash or local cheques. Or you can set “Standing Instructions”, so it automatically debits your bank account and credits to the RD account on a particular date of a month.

Features of Recurring Deposit

Duration: The minimum duration of a recurring deposit is 6 months and the maximum duration of 10 years or 120 months.

Nomination: The nomination facility has been made compulsory following the RBI guidelines. There can be only one nominee for the account. The account holder can change the nominee by submitting the prescribed application form. A minor can also be made a nominee provided the guardians’ names are cited for reference.

Maturity and withdrawal: The maturity date is often mentioned in the passbook. Up on maturity, you will be paid with principal amount along with the interest accumulated. Usually, the maturity amount is credited to the bank account.

Premature closer: If the account holder applies for premature withdrawal, the bank will pay the amount accumulated up to the date. However, a penalty amount will be levied in case of premature withdrawal.

Charges for late payment: The charges for late installments vary from bank to bank. But there are some banks that don’t levy penalties for late payments.

Tax Deducted at Source: Earlier, the interest on RD was not taxable as the Tax Deducted at Source was not applicable to RD. But, with the effects from June 2015, the norms have been revised. Recurring deposits are now being considered as taxable incomes. If the interest exceeds Rs.10,000 per annum, 10% will be deducted as TDS. If there is no PAN information, it will be 20%.

If your total annual income doesn’t fall under the income tax bracket, you can submit Form 15G to claim tax benefits on RDs. Senior citizens can fill up Form 15H.

Loan facility: Account holders can avail of up to 90% loan or overdraft against the balance in their RD account. But sometimes it’s more feasible to withdraw it in case of emergency rather than taking a loan against it.

Recurring Deposit Accounts for NRIs

Recurring deposit is a wonderful option for NRIs as well. It helps them multiply their small savings into lump sum amounts.

NRIs can easily save their money in Indian Rupee in two ways; NRE (Non-Resident External) Recurring Deposit account and NRO (Non-Resident Ordinary) Recurring Deposit account.

There are several banks in India such as Axis bank, ICICI bank, State Bank of india, HDFC bank etc who offer such facilities. Once you match the eligibility criteria and submit all the necessary documents, you can open your recurring deposit account. However, the NRI account facility is usually not available for people of Indian origin residing in Pakistan, Bangladesh without prior approval of RBI.

Whether you should choose NRO recurring deposit account or NRE recurring deposit account for investment, depends on the source of investment amount. If the investment amount is originating abroad/overseas, go for NRE recurring deposit account. If it’s originating in India then you should choose NRO recurring deposit account.

The Interest on NRI recurring deposit accounts is decided by the banking association of India. Currently, it’s hovering around 7.50% in most of the banks.

NRI RD accounts don’t allow partial payment of installments. However, premature closure, nomination, and joint account holder facilities are all available for NRI recurring deposit accounts.

However, you should properly go through the terms of services before opening the account or speak with the bank executive about this.

NRO Recurring Deposit Account

- NRO Recurring deposit account allows you to save your legitimate income earned in India through rent, dividends, pension, interest etc.

- You can save the domestically earned money in NRO recurring deposit every month.

- The interest on NRO recurring deposit accounts is taxable.

- Funds can be transferred to NRO recurring deposit accounts from NRE or NRO savings accounts.

- This is repatriable subject to certain guidelines.

- The investment tenure has a maximum period of 10 years and the amount can vary from banks.

NRE Recurring Deposit Account

- When the amount of investment sources from the income earned overseas or abroad, you can save it in NRE recurring deposit account.

- Here, the amount of installment to be deposited in the NRE recurring deposit account must be transferred from the NRE savings account only.

- The interest earned on NRE RD accounts is non-taxable and fully repatriable.

- The interest is only payable at maturity.

- The minimum and maximum lock-in period is 1 year to 10 years.

Very informative and nicely written. Thank you for the great article.