Withdrawing your PayPal funds to your bank account in India is a simple and straightforward process. However, there seems to be some confusion around PayPal India transaction fees and conversion fees.

Also, many PayPal users want to know how to calculate PayPal fees in India.

In this post, I’ve tried to answer all those queries based on my personal experience. Please, note that I have been using PayPal services since 2009.

Ok, so here we go…

How Much PayPal Charges for Withdrawals in India?

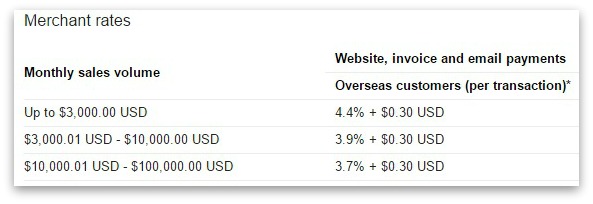

PayPal has different withdrawal charges for different slabs.

If your monthly remittance is below 3000 USD, PayPal will deduct 4.4% on your every transaction plus 30 cents additionally.

While this might appear complicated to some, the actual math is pretty simple. In fact, as per my own experience, PayPal charges nearly 5% on every remittance from overseas customers, especially when your monthly sales volume is below $3000 as shown in the table chart above. In other words, PayPal pays you 95% of the amount remitted to you.

Here’s a simple calculation on how much you should ask your client to pay:

For example,

The amount your US client owes you: $100

Add: Approx PayPal Withdrawal Fees: 6% of $100 = $6

Ask Your Client to Pay: $106

Amount PayPal will deduct: $106 x 5% = $5.3

Amount Your Receive after PayPal Withdrawal Charges: $106 – $5.3 = $100.7

Important Note:

The above calculation makes sense only when the amount remitted is below $400-500. Why?

Consider the following example:

If your client owes you $500, then you need to ask him to send you 106% of $500 i.e. $530 where $30 is the approximate PayPal Fees.

In this case, your client can simply send you the money via Online Wire Transfer where the bank will charge a flat $20 for the service.

There are two benefits of doing Wire Transfer in this case.

#1: Your client can save approximately $10

#2: You receive money at better exchange rate, i.e. nearly 2 rupees per every USD.

When You Should Propose Wire Transfer

Assuming your US client owes you $800, let’s compare Remittance via PayPal vs Wire Transfer.

Remittance via PayPal

You Ask for: $848

PayPal Fees: $42.4

You Get: $805.6

Prevailing Currency Rate: $1 = Rs. 65

PayPal Currency Rate: $1 = Rs. 63

Amount Transferred to Your Bank A/C: $805.6 X 63 = Rs. 50, 752.8

Remittance via Wire Transfer

You Ask for: $800

Bank Wire Transfer Fee: $20

You Get: $800

Prevailing Currency Rate: $1 = Rs. 65

Amount Transferred to Your Bank A/C: $800 x 65 = Rs. 52,000

How Much Did You Both Save?

You Saved: Rs. 52,000 – Rs. 50,752.8 = Rs. 1274.2

Your Client Saved: $42.4 – $20 = $22.4

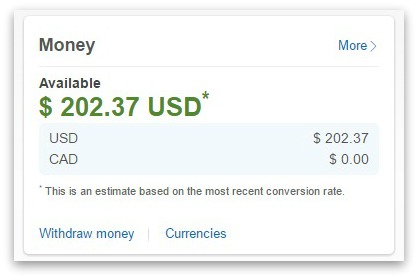

Now that you have understood how much PayPal charges per each withdrawal, it’s time to learn how to withdraw money to your bank account.

How to Withdraw PayPal Funds to Your Bank Account

Step #1: Log in to your PayPal dashboard and click on the Withdraw Money option.

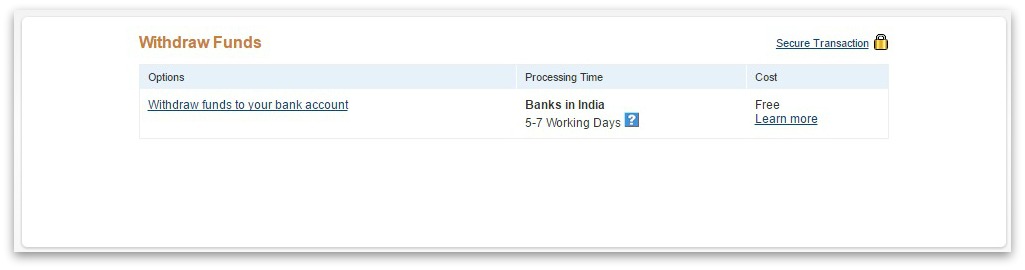

Step #2: Click on Withdraw Funds to Your Bank Account.

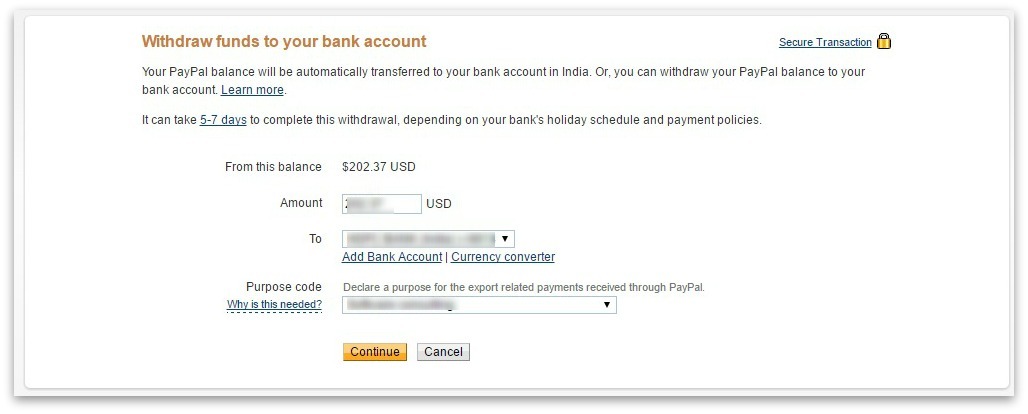

Step #3: Enter the amount you want to withdraw from your existing PayPal funds balance. If you multiple bank accounts, choose which bank account you want to transfer the fund to. Choose the purpose code. The click on Continue button.

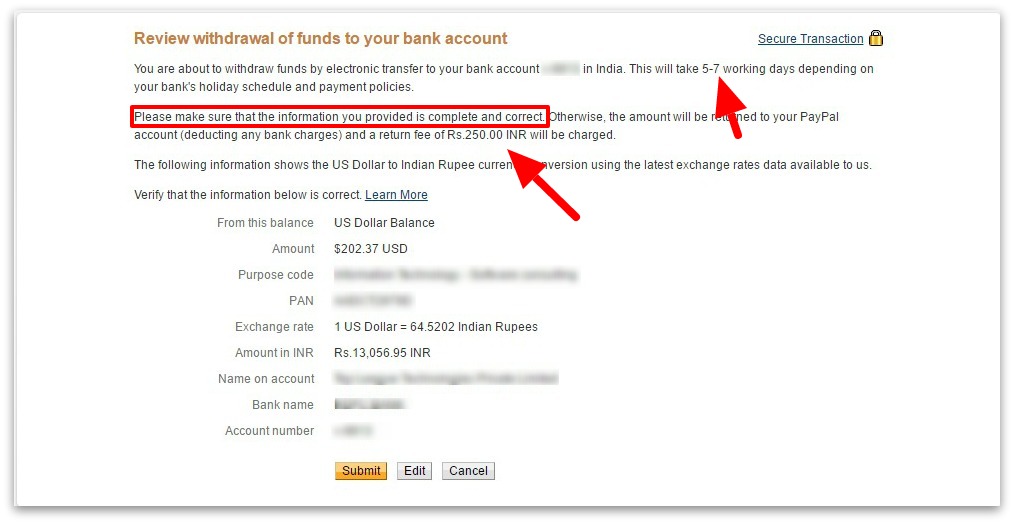

Step #4: Review withdrawal of funds to your bank account. PayPal will levy a penalty of Rs. 250 on each failed withdrawal arising out of incomplete info. So, review the info and ensure everything is correct. Once, you’re sure, hit Submit.

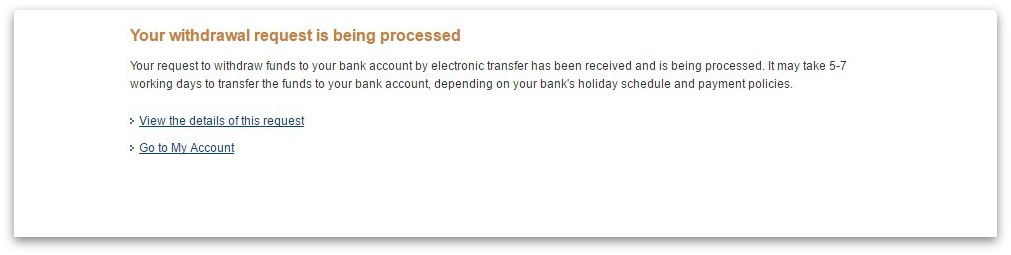

Step #5: You should be able to see the following message when you have initiate the PayPal funds withdrawal process.

Step #6: If you want to view the details of your funds withdrawal request, click on the appropriate link. Else, click on Go to My Account.

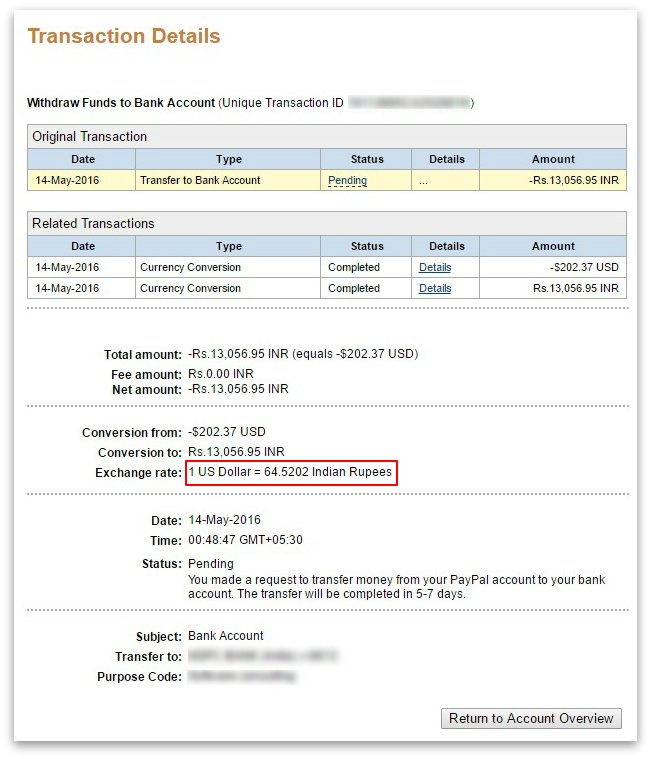

Step #7: Upon funds withdrawal request, PayPal will present you a table containing the details of the request. As you can notice in the screenshot below, the PayPal exchange rate is $64.5 per 1 USD. FYI, the prevailing market rate on the day was $67.

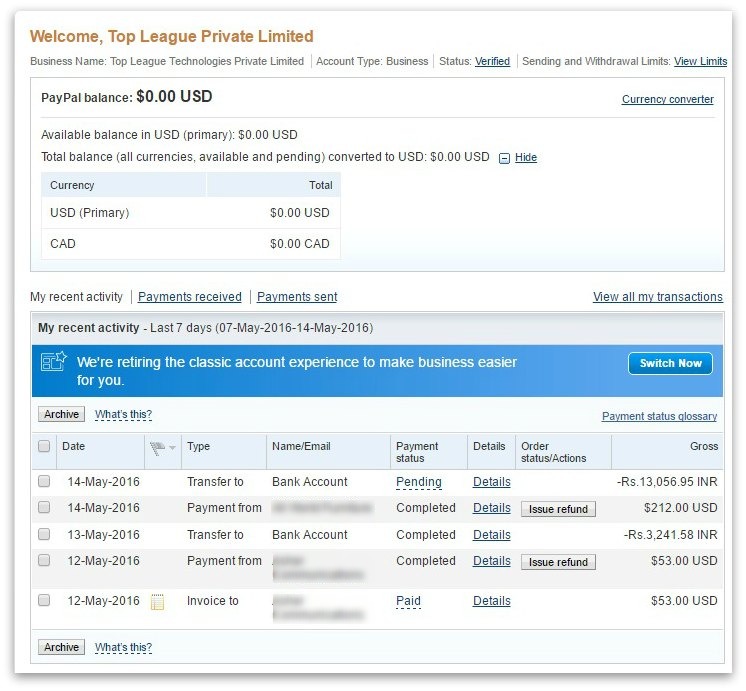

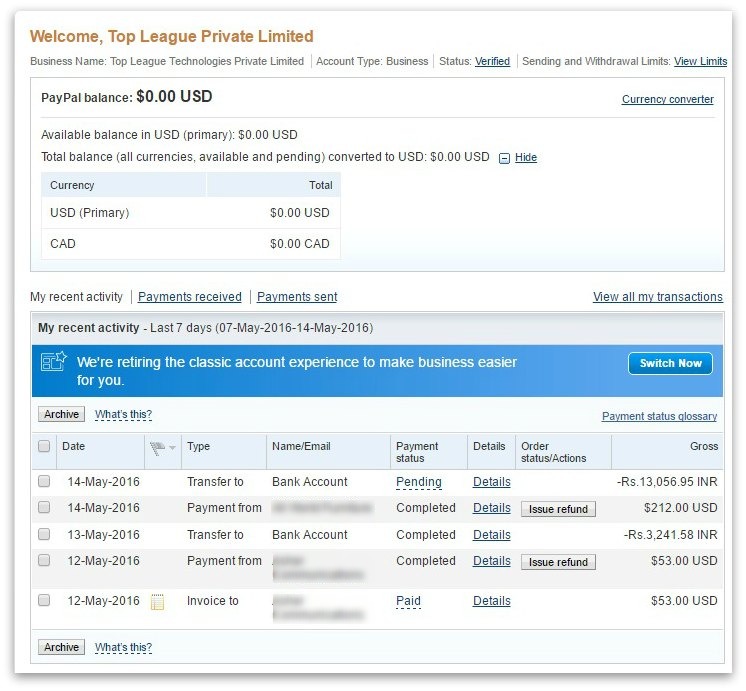

Step $8: If you choose to go back to your dashboard (My Account), you can find Payment or Withdrawal status or your recent transactions.

Hope you find this PayPal withdrawal guide helpful. Please, share this post with your friends and leave a comment if you have any questions. I will try my best to help you out.

Leave a Reply