Many banks are now offering a special kind of saving account to their female customers – woman’s saving account. But, is this really worth it?

Banks such as ICICI, HDFC, Kotak Mahindra, and RBL offer customized bank accounts for women.

On the surface, it might sound like different from a regular saving account, but there are quite a few things you should consider in order to determine whether it’s for you.

A bank would tell you there two unique features a woman’s saving account offer: cash back rewards and other benefits to suit a woman’s’ banking requirements.

Is it Suitable for You?

According to Naveen Kukreja, CEO & Co-founder, paisabazaar.com, Woman’s Saving Accounts are suitable for women who want to have same minimum balance as available on a regular saving account while enjoying higher benefits. A woman’s saving account can be an individual or joint account with woman being the primary account holder. Woman’s Saving Accounts usually offer a host of customized features linked with a debit card.

What do These Accounts Offer?

Woman’s Saving Accounts offer some unique features that are not available with regular saving accounts. For example, the woman’s saving account, known as ‘Silk – Women’s’ Savings Account’, offered by Kotak Mahindra Bank features home banking services such as cash pick-up, cash delivery, cheque/draft delivery among others. However, these services are available only in select cities.

HDFC offers accidental hospitalization cover of Rs. 1 lakh and accidental death cover of Rs. 10 lakh. Similarly, RBL Woman’s First Saving Account allows account holders to withdraw cash at all ATMs without any extra charges.

Woman’s Saving Account vs Regular Saving Account

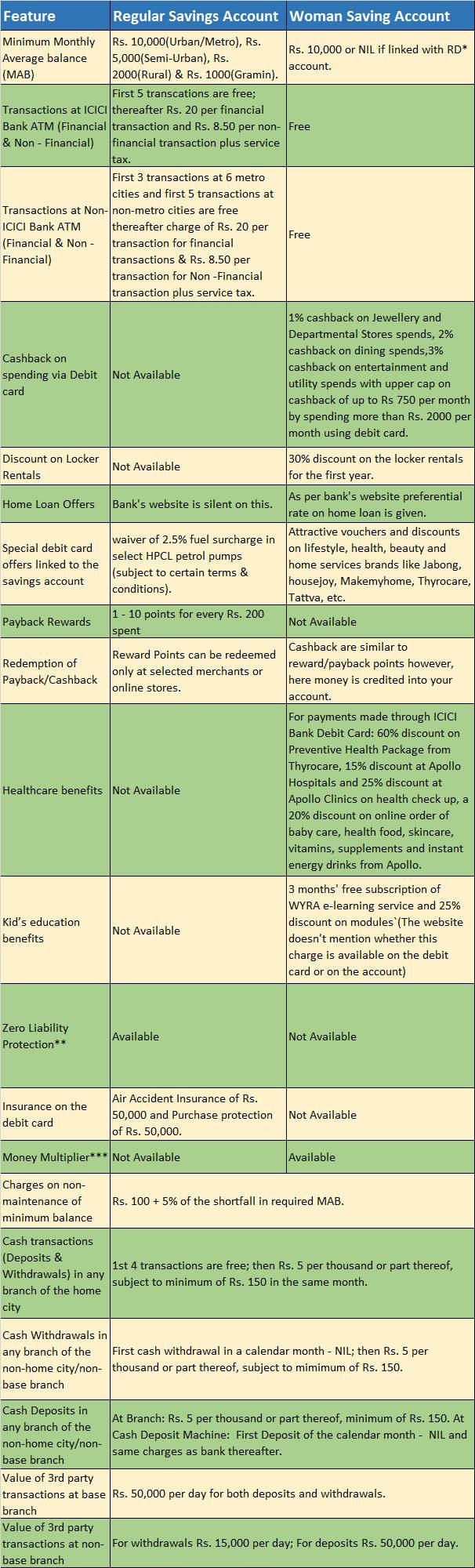

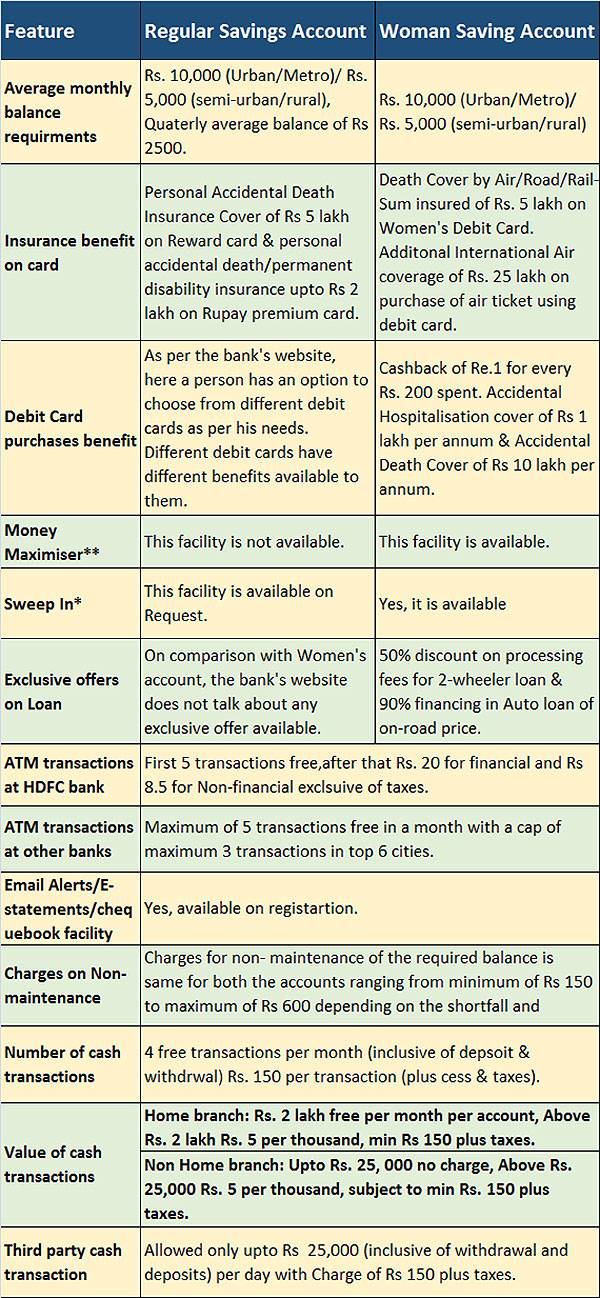

Below is the comparison of the Women’s Savings bank account with regular savings bank account.

ICICI Bank: Regular Savings Account vs Woman Savings Account

HDFC Bank: Regular Savings Account vs Woman’s Savings Account

Is it Really Worth it?

While the minimum balance remains the for both types of saving accounts, woman’s saving accounts still outscore regular saving accounts in terms of offers, discounts, insurance cover and debit card transaction limits.

Leave a Reply